The British Imperial Expansion

It could be said that Britain was relying more and more on empire outlets, whereas the Empire on the other hand was reducing its dependence upon British manufactures. For example, among exports of small value such as beer, soap, books, luxury foods, Britain continued to find empire countries the major buyers. “Australian woman loved to parade in hats from London while eating English chocolates and sipping English tea. Among exports of high value the empire was becoming an essential outlet. Whereas one century previously textiles went out three pieces to foreign countries and to the empire, in 1930 the destinations were pegged almost evenly.”19 There was a growing sense of economic independence, plans for industrialisation and search for diversified trade among the more developed economies (of the dominions). British manufactures had little reason to have ling-term faith in those empire outlets. Britain could not expect to maintain her share in those countries.

However, Britain was still able to wield authority as a financial centre of the world in comparison with its decline as a trading power. Invisible earnings had always kept British accounts balance. Those earnings were achieving through being a world banker, shipper and insurer, and particularly through dividends from overseas investments. The significance of the income from overseas investment is shown by its increase as a part of the national income, from 4% in 1880 to 10% by 1914. The yearly income from these investments between 1870 and 1914 averaged out at £110 million; obviously it was higher at the later date (1913, £210 million on a total investment of over £3,700 million). This British financial supremacy was at a peak just before the 1914-18 war. But international crises and internal weaknesses buffeted Britain and she did not succeed in trying to recover and maintain her position during the nest twenty years after the 1914-18 war. As a result she was replaced by the United States as chief creditor of Canada and much of Latin America (especially the Argentine and Chile), but she maintained her position in “Australia, India, Africa, her Eastern Empire and China. Also she was investing considerably in the Middle East for oil and other areas such as Venezuela. Overall Britain was declining faster in trade than in investment, and while in the 1930s no-one could doubt the power of the American dollar, London remained as a leading financial centre.”20 At the same time, however, this situation was somewhat misleading. The economy of Britain had serious flaws. The pound was over-valued and Britain’s relative trading decline placed strains on the financial ability of the British capitalist. By 1939 the economic advance of Germany and Japan together with the untested economic might of the United States were posing crucial threats to the maintenance of Britain’s position as a great power in the world.

Notes:

1. J. MORRIS, Farewell the Trumpets. (London: Faber & Faber, 1978), p.24.

2. ibid., p. 25.

3. ibid.

4. ibid.

5. ibid., p.26.

6. ibid.

7. ibid., p. 27.

8. W.R. JOHNSTON, Great Britain, Great Empire. (Queensland: Queensland U.P., 1981, p.97.

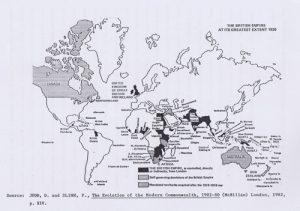

9. D. JUDD and P. SLINN, The Evolution of the Modern Commonwealth 1902-80. (London: McMillan, 1982), p.4.

10. ibid., p.5.

11. ibid.

12. ibid., p.6.

13. W. D. MCINTYRE, Commonwealth of Nations. Origins and Impact, 1869- 1971. (Minneapolis: Minnesota U.P. & Oxford U.P., 1977), p.35.

14. W.R. JOHNSTON, op. cit., p. 107.

15. ibid., p.108.

16. ibid.

17. ibid., p.109.

18. ibid.

19. ibid., p.110.

20. ibid., p.118